the tax shelter aspect of a real estate syndicate

Tion on Real Estate and its Recapture. Reform of Real Estate Tax Shelters 7 U.

:max_bytes(150000):strip_icc()/DDM_INV_REIT_final-c25e927cfd044ee79c56a6ddf1a6a696.jpg)

Real Estate Investment Trust Reit How They Work And How To Invest

Following closely on the heels of Otto H.

. Philadelphia Syndicate Pays 1000000 for 750-Acre Tract at Wantagh LI. The tax shelter aspect of real estate syndicates no longer exists. A tax shelter is a vehicle used by taxpayers to minimize or decrease their taxable incomes and therefore tax liabilities.

Thus investors cannot deduct their real estate losses from income. Under section 448d3 a taxpayer that is a syndicate is considered a tax shelter. True The tax laws prevent real estate investors from taking losses in excess of the actual amounts they invest.

Your CPA or Tax advisor is the best person to. California will maintain its. For purposes of section 448d3 a syndicate is a partnership or other entity other than a C.

Your business qualifies as a. Many people look to Real Estate Syndication for tax purposes. They have passive activity gains and need a shelter.

The tax shelter aspect of real estate syndicates no longer exists. Resolving Problems Raised by the 1969 Act 29 NYU. Tax shelters can range from investments or.

-- Boys Club Secures Site for Addition to Its Home -- Washington Heights Taxpayer Sold to Investor. Limits taxpayers ability to use losses generated by real estate investments to offset income gained from other sources. Resolving Problems Raised by the 1969 Act 29 NYU.

All Aspect Property Maintenance Company West Babylon NY 11704. Tax Considerations in Real Estate Syndication Published by Villanova University Charles Widger School of Law Digital Repository 1958. Although it is easy to see that a registered offering partnership or arrangement having a significant purpose to avoid or evade federal income taxes is a tax shelter it is less.

Kahns purchase of the 2000 acre Nicoll estate on Shelter Island LI it was learned yesterday negotiations are under way by which a New York.

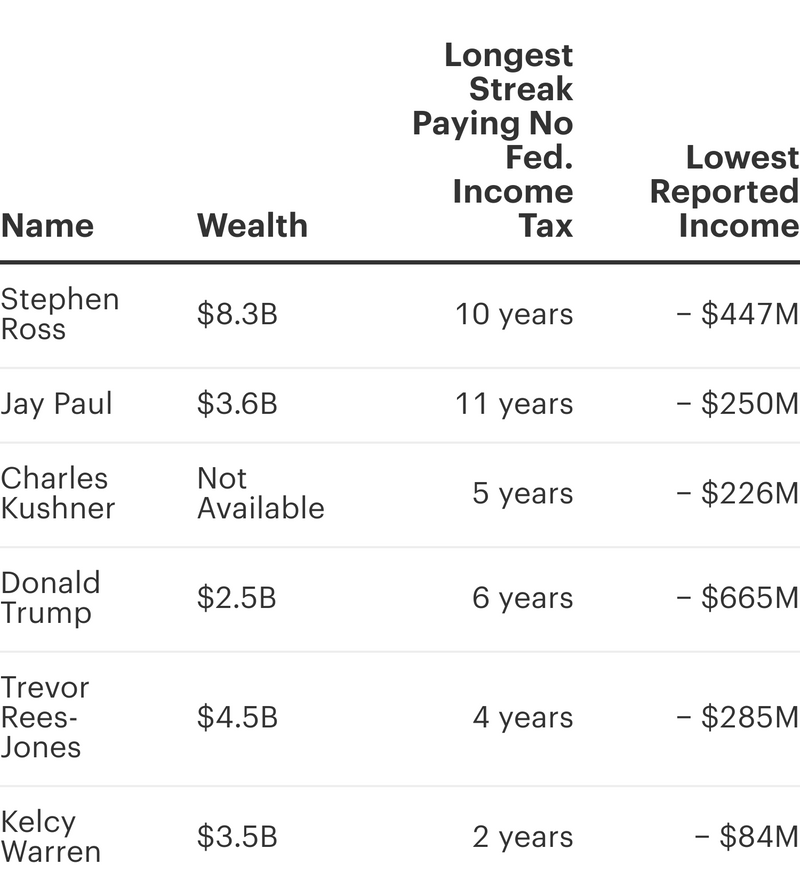

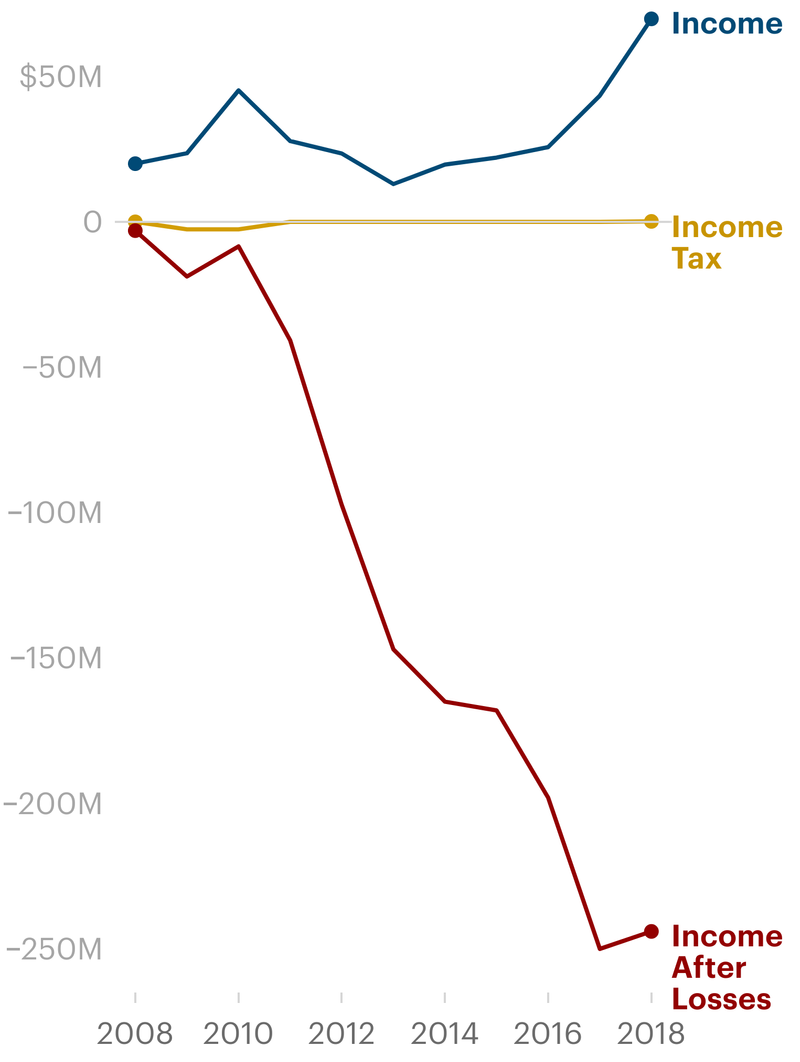

These Real Estate And Oil Tycoons Avoided Paying Taxes For Years Propublica

Helping High Net Worth Individuals Invest In Real Estate With Letizia Alto And Kenji Asakura

Principles Of Real Estate Syndication By Samuel K Freshman Ebook Scribd

Website Design Margaret Cogswell Designs

These Real Estate And Oil Tycoons Avoided Paying Taxes For Years Propublica

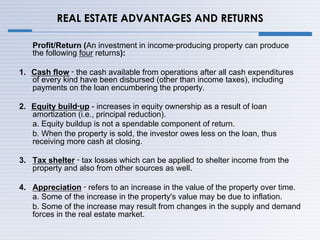

Investing In Real Estate And Other Investment Alternatives Ppt Download

Wyoming Trusts Protected By Strong Privacy Laws Draw Global Elite Washington Post

Inside The Property Syndicates Money Archives

How We Invest In Real Estate White Coat Investor

Intro To Real Estate Investing

Insight In The Beginning Was The Reit

Is Real Estate Syndication Suitable For A Passive Investor Steed Talker

Real Estate Syndication Tax Benefits Holdfolio

Basics Of Leading Real Estate Syndications Semi Retired Md

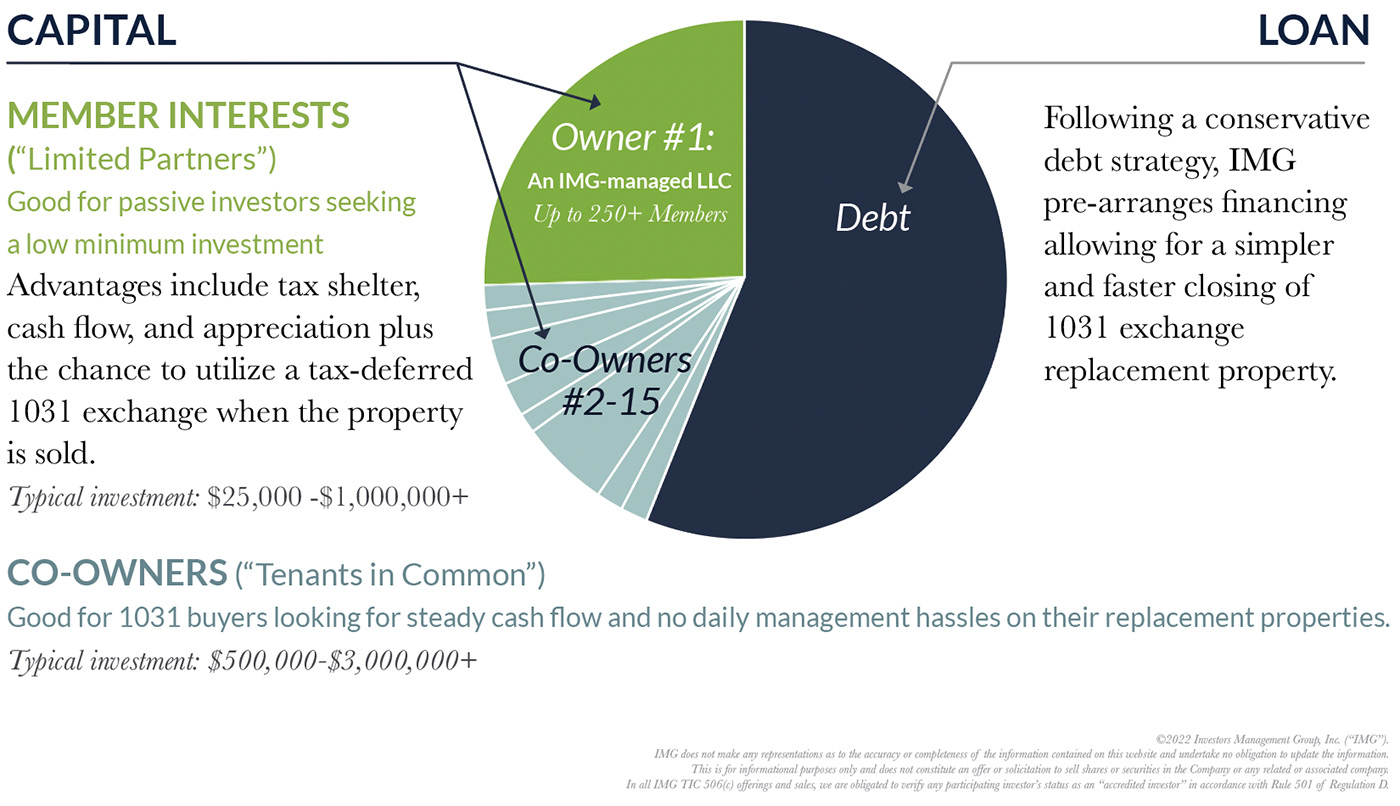

Our Investment Strategy Investors Management Group Inc

Real Estate Syndication Tax Benefits Holdfolio

Podcast Top Real Estate Tax Questions Answered

Why I Quit Buying Rental Properties To Buy Reits Instead Seeking Alpha

The Ultimate Guide To Passive Real Estate Investing In Multifamily Via Syndication Willowdale Equity